{tocify} $title={Table of Contents}

India: The Best Performing Emerging Market

Emerging since the year 1991. The Indian market, after adding more than a million new retail investors during the coronavirus pandemic is performing better than its Emerging Market (EM) peers so far in 2021, and at some stage, at the global level. Note that this article I wrote on 24th September, and may be published on the weekend. So, consider all the data till the 24th.

How it became the best performing EM and the statistics

In recent years, the accessibility to market for small new retail investors has increased significantly, thanks to the accessibility to technology, the availability of free online education - in many cases from unaccredited financial magicians - the quick money makers. Additionally, the likes of Rakesh Junjunwala in the field of investment influenced the Indian youth to get started with their investing journey, sharing their success stories and the magic formula, of course.

Anyway, talking about the Indian market, the benchmark index of the National Stock Exchange (NSE), Nifty50 gained a huge 27.35% year-to-date (YTD) in 2021, which is the highest among its EM peers. Sensex, from the Bombay Stock Exchange (BSE), has gained 25.44% during the same time.

Here are the top Emerging Market indices - performance during 2021 so far.

| Index | Country | Close | YTD % |

|---|---|---|---|

| Nifty50 | India | 17,853.20 | 27.35% |

| Sensex | India | 60,048.47 | 25.44% |

| Taiwan Cap Wei | Taiwan | 17,260.19 | 15.82% |

| SET | Thailand | 1,631.15 | 12.54% |

| Kospi | South Korea | 3,125.24 | 6.14% |

| IDX Composite | Indonesia | 6,144.82 | 0.65% |

Mainly, due to the reduction in covid-19 cases in the country, giving a positive signal of the back-on-track - India as the fastest growing economy in the world to the investors - foreign as well as domestic. Moreover, China's big tech crackdown left its foreign investors fearful and India, as the best 'growth' option. Additionally, due to the increasing spread of the virus in other EM peers, India is reporting more foreign investments in 2021.

Meanwhile, India's second virus wave was passed in March and May with a record vaccination drive, it benefitted the country with the only growth opportunity in the perception of foreign investors. To just push this perception furthermore, the Chinese Evergrande situation was the last thing investors wanted, which is also referred to as the Chinese Lehman Brothers-like crisis, which was the reason for the 2008 financial crisis.

Bloomberg recently reported that the Indian stocks are outpacing the world by most since 2018. It added that a tide of foreign inflows and domestic liquidity has helped fuel a 132% surge in Indian stocks from their March 2020 lows. According to data from PTI, the Foreign Direct Investment (FDI) to India increased 112% or $20.42 billion in April-July 2021 quarter to reach $27.37 billion. With this, FDI inflows more than doubled as compared to the same period a year ago.

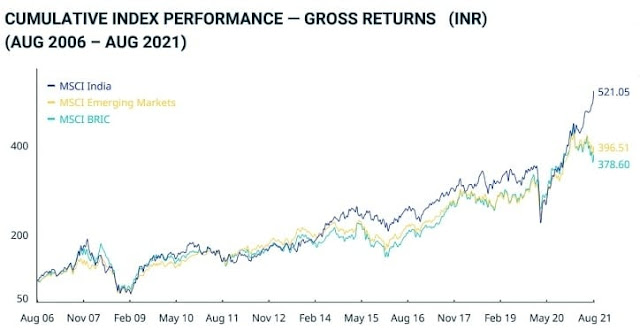

The MSCI India Index, a measurement index of market performance in a particular area, its gross return during this year, till August 31, 2021, is at 25.95%, as opposed to MSCI Emerging Market Index's 2.98%. For information, the top 10 constituents in the index include Reliance Industries, Infosys, HDFC, ICICI Bank, TCS, HUL, Bajaj Finance, Axis Bank, Bharti Airtel, and HCL Technologies with the dominance of the financial services sector.

|

MSCI India Index vs. MSCI Emerging Market Index - Source: MSCI |

The Indian index is also eyeing the eighth straight monthly gain. According to Business Standard, such a streak has only been seen twice in the past two decades, in 2003 and 2007. Additionally, in 2021, the market cap of all listed firms in India has jumped 41%, which is most among global markets with at least $500 billion in market cap, as reported by Samie Modak. During the last year, the Indian stocks added $1 trillion to market capitalization. India has climbed two positions on the table of the world's most valuable equity markets in 2021 to reach the 6th position with $3.55 trillion from $2.52 trillion.

|

The top eight largest stock markets by market capitalization in the world |

With the record inflows, the domestic participation of retail investors, as mentioned above is also increased significantly. The huge number of market participants has helped India to achieve the top spot among emerging markets. If the technology and accessibility are a driver of those participants to the market, a high number of initial public offerings (IPOs) in the FY22 is the fuel. The IPOs provided investors with an alternative path to earn quick money.

The Investment Opportunity

The one more positive point from the market analysts indicate that the recent rally from March 2020 low is broad-based, meaning the growth is not few-stocks-focused. The companies were working to improve their balance sheets since the pandemic began, and are reported to be successful in it.

However, in the last quarter, I found one research that cited that companies were firing employees to improve balance sheets and cash reserves. Today, unemployment, especially among the youth is a major concern in India. Moreover, another factor is the rising inflation in the Indian economy, although the Reserve Bank of India (RBI) governor Shaktikanta Das calmed down the bond market by saying the inflation will be eased in the upcoming year.

advertisement

Taking valuations now, Kotak Institutional Equities, in a note cited that the valuations of the Indian companies look full and are supported by the expectations of strong earnings growth over the next financial years and stable-to-modestly higher interest rates over the next few months. In my previous editorial, I mentioned a quote from David Haynal, in which he said that "the investors are trying to judge how the normalization of economies will impact the equity market." Meaning, the expectation of strong earnings from companies, which can be baseless without proper fundamental analysis - Previous editorial.

Furthermore, the point which every investor should consider is the inequality in the country, which overall can hinder the broad-based growth. The RBI governor added that "India's financial system is maturing and economic growth is on the mend, but the pandemic has asymmetrically affected the population." However, he further said that "it should be fixed through big infrastructure development." Meaning, the infrastructure development can attract global brands to invest in India, and it can subsequently, generate employment opportunities in the country.

The RBI governor further asserted that there is a steadily maturing financial system - moving from a bank-dominated financial system to a hybrid one. And the Production Linked-Incentive (PLI) scheme overall contributed to the economy. The PLI scheme, making India a manufacturer, has helped to make India - from net importer of smartphones to net exporter, making India the global smartphone manufacturing hub. This trend, when spread over other sectors, as we have seen government doing the same, with the help of enhanced global supply chain will help build a strong economy.